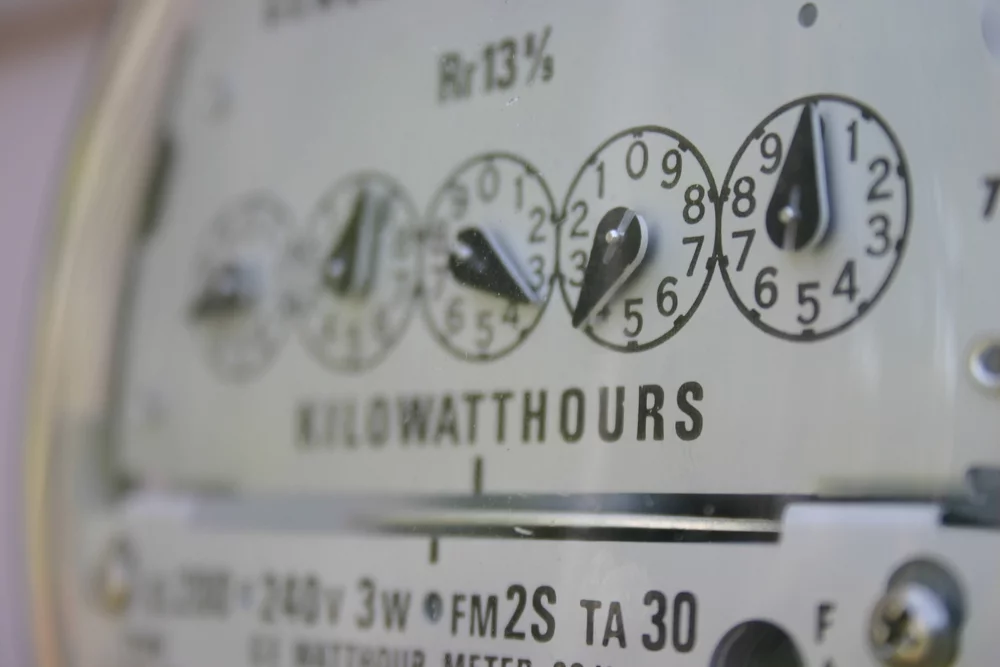

The rise of integrated resource plans (IRPs) can be traced back to the 1980s when significant changes in the energy industry—from the introduction of energy efficiency to the high costs of building nuclear power plants to the oil embargoes of the previous decade—led many states to require utilities to submit their long-range plans for using ratepayer resources. The “just burn more coal” mantra was starting to fade, so regulators needed to see the forecasts for long-term energy demand understand how utilities planned to supply that demand, and help ensure reliable and cost-effective power for customers.

Why IRPs are More Important Than Ever

Today, as utilities balance new technologies, the rise of a suite of renewable resources, and the exponential growth of low-cost battery storage to shave peak demand, IRPs have become increasingly harder to push through regulatory hurdles.

– Jeff Quigley, VP of Customer Solutions, Virtual Peaker

This recent blog post from the Union of Concerned Scientists provides a half-dozen examples of why state regulators rejected IRPs. In general, the “fails” turned into wins—for companies and consumers—when utilities focused “less on building generation and more on the transmission and distribution system to handle a high renewable grid.” Plus, investors tended to respond favorably to the revised, realistic, and renewables-focused long-term planning documents.

Earlier this year, Duke Energy’s 15-year IRP was summarized as “too expensive, maintains old and inefficient coal plants, and builds unnecessary gas plants.” Duke’s IRP called for 9,534 MW of new gas capacity and just 3,671 MW of new solar capacity. This August, E&E News shared its utility trends shaping electricity’s future. Not surprisingly, a number of the observations are consistent with how many of Virtual Peaker’s forward-thinking clients run their businesses:

-

One of the recurring themes for IRPs is not whether utilities will cease operating coal-fired power plants, but when they will shut them down in favor of renewable technologies.

-

Following the surge of wind power, then solar, and now energy storage—particularly battery storage—solutions that are scalable and increasingly less expensive now can be found in IRPs across the country.

-

The correct answer is “all of the above,” with utilities seeking a strong and varied mix of generation and storage resources that are more climate-friendly. IRPs are now starting to live up to their acronym, providing integrated resource planning!

When mega-expensive IRPs are sent to state regulators with minimal data behind the assumptions, we all lose. And they’re betting on the future with ratepayer dollars. At Virtual Peaker, we see the challenges associated with IRPs as opportunities to challenge the status quo, and ultimately do right by all of the stakeholders involved.

How can we help? We’ve got the technology to scale up utility investment. We can pilot programs, using real-time data from your own customers, to create a strategic plan that can be tweaked as we help you grow your business. Contact us if you would like to speak with someone on our customer support team or request a Virtual Peaker demo.