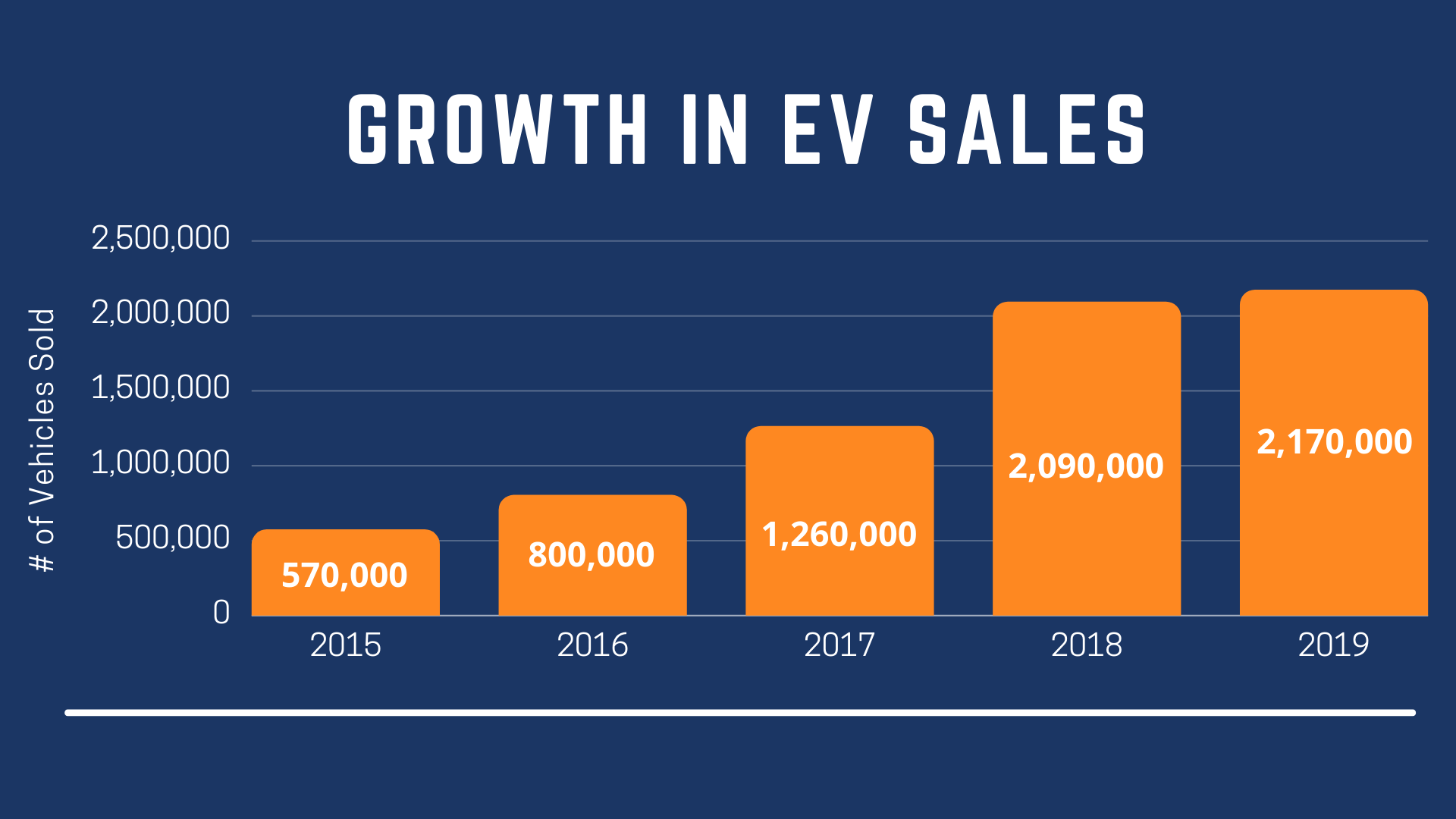

The global electrical vehicle (EV) market has been rapidly growing over the past few years, with 2021 United States EV sales predicted to increase 70% year over year following the sharp fall in sales in the spring of 2020 as the coronavirus caused an economic contraction. Moving forward, changing legislation, new technological developments, potentially attractive new models of both fully electric vehicles and plug-in hybrids will all play a critical role in the growth of the industry. By 2040, it is forecasted that more than half of all passenger vehicles sold will be electric.

EV Consumer Models, Trucking, Shipping & Aviation

Much of the existing electric vehicles in the market are consumer models such as Elon Musk’s Tesla, but technological progress regarding the electrification of two/three-wheelers, buses, and trucks along with advancements in the electrification of seaport opportunities has increased over the year and is further expanding the size of the global EV market. In 2019, global sales of electric trucks hit a record high of 6,000 units (figures for 2020 not yet available) while a variety of companies continued to develop new models.

Much of the growth in this sector is driven by research and development in dynamic charging concepts along with demonstrations of catenary line solutions that may increase the potential for long-distance operations such as long-haul trucking. The shipping and aviation sectors have also experienced growth regarding electrification, a process that has been supported by varying legislative measures. Before we dig deeper into how new laws are reshaping the fight against climate change, let’s take a look at the scale of the evolving EV market.

Players in the Electric Vehicle Market

Many electric vehicle challengers have risen in the playing field to compete with the EV frontrunner Tesla and existing models from major auto companies Ford and General Motors, with many supported by a significant amount of funding from Wall Street. Some examples of up and coming competitors include:

- Rivian Automotive LLC, a privately held company backed by Ford, Amazon, and BlackRock Inc. that has a contract to build 100,000 electric delivery vans for Amazon. The first consumer model from the company will hit the market in June 2021.

- Nikola Corp, a public company, is set to begin production of a battery-powered semi-truck in late 2021, targeting the commercial trucking market and intending to make big rigs powered by electric batteries and hydrogen fuel cells.

- XPeng Inc., a public Chinese company backed by giants such as Alibaba, makes SUVs and sedans that undercut Tesla’s Chinese models on price and is working on developing an autonomous-driving software for its electric vehicles.

- Arrival Ltd. a private company that is expected to go public later this year plans to release an electric passenger bus in the 4Q21.

Policy Pressures

Because factors such as lower gasoline prices can often make electric vehicles less attractive of an option, the success of the market often depends on the type of supporting legislation available. Policymakers continue to push the auto market towards lower emissions, with quote systems, fuel economy regulations, and city policies all playing an increasingly important role. EV advocates have been calling on Congress to take additional steps to boost federal incentives for EV demand, hoping for lawmakers to expand the US $7,500 federal tax credit by raising a cap that currently does not allow consumers purchasing from the two largest US EV producers, Tesla and General Motors to qualify for the credit.

Regarding policy for shipping and electrification, the electrification of shipping operations at ports has started to gain the legislative support of regions such as Europe, China, and California, as these types of operations are gradually becoming mandated by policy. Regarding aviation, electric taxiing (electrification of aircraft ground operations) allows for a decrease in airline operating costs and reduction of CO2 emissions, the latter of which is also supported by a variety of existing policies.

V2G & Charging

Off-peak electricity demand charging, dynamic controlled charging (V1G), and vehicle-to-grid (V2G) are all able to play a critical role in mitigating the impact of EV charging on peak demand. V2G charging technology refers to a technology that enables energy to be pushed back to the power grid from the battery of an electric car (allowing for bidirectional charging flow) and can help reduce energy use on the grid during peak demand.

An example of innovation regarding V2G involves Green Mountain Power’s (GMP) pilot program with Virtual Peaker that aims to incentivize electric vehicles (EV) adoption while encouraging customers to share access to their residential vehicle chargers. Participants in the program receive a free level-2 charger with the purchase of an EV and can charge their car as much and as often as needed while GMP limits charging during peak events in response to grid conditions in exchange.

Electric Vehicle Market Conclusion

With technology changing more and more every day, preparation is key. Electric vehicles are inevitable to the point that our entire infrastructure is evolving to meet interest. Along with an increased shift toward electrification will come a reimagining of what the modern grid can be. Are you prepared to tackle the challenges that electric vehicles pose to load shapes?